1) 2Q21 results

2Q21 was a record quarter for UTDPLT in terms of revenue (RM481.9m) and PATAMI (RM135.8m). This was despite the fact that 2Q21 results were dragged by RM34.1m of realised losses on commodities futures contracts.

PE multiple for the stock is 10.5x if we annualise the 2Q PATAMI.

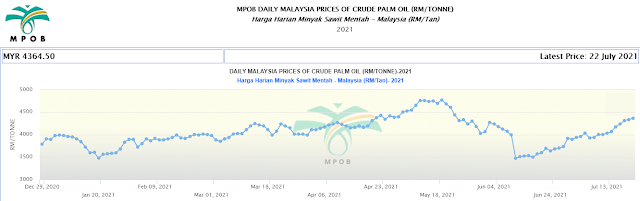

Palm oil prices ranged between RM3,200/MT and RM4,500/MT in 1H21. However, UTDPLT recorded relatively lower average selling price of RM2,967/MT (Malaysia: RM3,020/MT; Indonesia: RM2,751/MT) in 1H21.

This was because UTDPLT practises a forward sale policy. In a rising trend, UTDPLT would record lower average selling price than market average, and vice versa.

2) Likely higher average CPO selling prices in coming quarters

Given the palm oil price is on an uptrend, UTDPLT is likely to report stronger average selling prices in coming quarters versus that of 2Q21.

UTDPLT is likely to report stronger average selling prices in coming quarters (vs 2Q21) as UTDPLT's 1H21 average selling price was significantly lower than year-to-date average, even lower than the lowest of year-to-date daily palm oil price.3) Improved margin of safety after a divergence between CPO price and share price

UTDPLT share price closed at 1-year high of RM15.00 on 21 September 2020 while CPO price closed at RM2,909.50/MT on the same day. Since then, UTDPLT share price has eased to RM13.72 last Friday but the CPO price ended significantly higher at RM4,364.50/MT. Due to the divergence, margin of safety for UTDPLT has improved.

12-month share price performance of UTDPLT.

4) In net cash with minimal borrowing As of end-2Q21, it was in a net cash position of RM411.4m, or 7.2% of its existing market cap.

5) Decent dividend yield

Assuming it can maintain FY20 dividend payout of 85sen/share, this will translate into a dividend yield of 6.2%.

6) Most importantly, UTDPLT is a well-run company

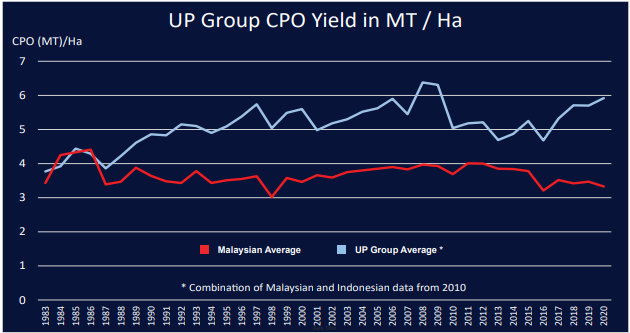

a) It recorded a CPO yield of 5.93MT/ha for FY20 (Dec), among the highest in the industry.

IOICORP 4.64MT/ha for FY20 (Jun);

KLK 4.81MT/ha for FY20 (Sep);

IJM 4.2MT/ha for FY20 (Mar)

Superior CPO yield

b) It has 587km of light railway system within its estates to facilitates an efficient transport of harvested FFB to the palm oil mill for production of high quality palm oil.

Light rail system within UTDPLT estatesc) The total cost of production including depreciation and additional remuneration/ bonuses is among the lowest in the industry at RM1,235/MT for 2020 and RM1,286/MT for 2019.

d) On average UTDPLT can harvest 12ha/worker versus industry average of 8ha/worker.

e) World's first RSPO certified company.

f) Among the earliest to issue annual report. UTDPLT issued FY20 (Dec) annual report on 22 February 2021. As the company is able to issue the annual report within 2 months from the close of the financial year end, Bursa has allowed UTDPLT to dispense the announcement of 4Q results.

Is it time to relook at United Plantations Berhad?

Join our facebook page: Bursa Stock Talk | Facebook